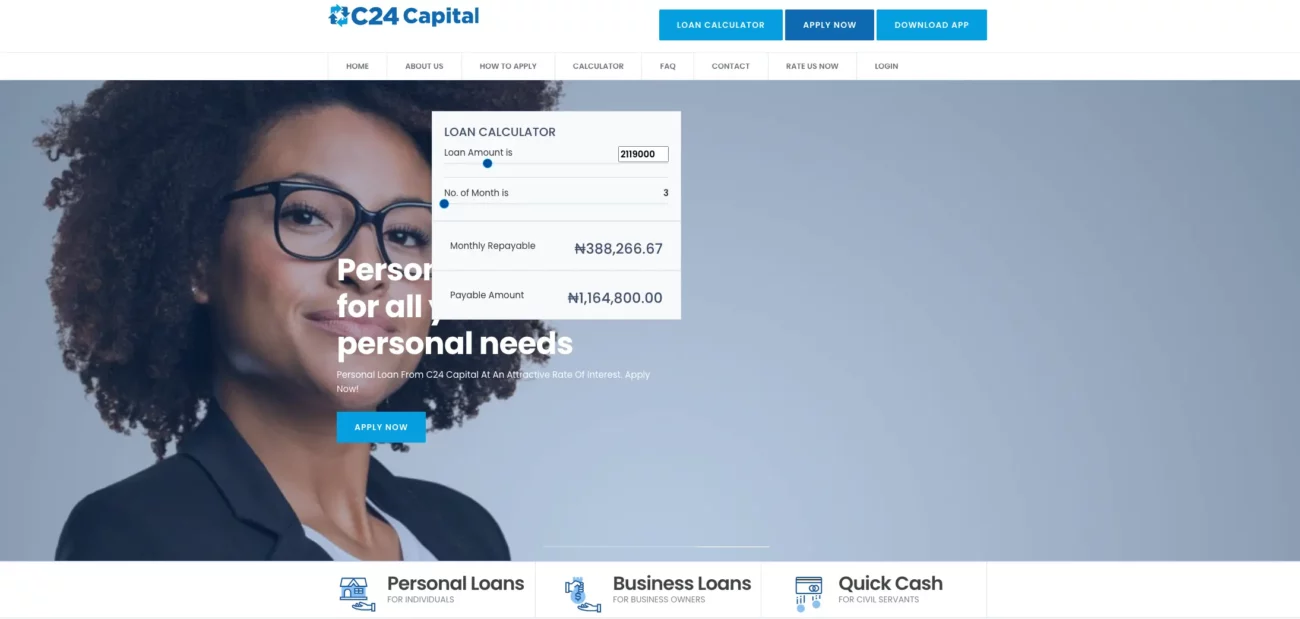

C24 Loan – A Comprehensive Lender Review

- Posted by Credit Nigeria

C24 is a financial institution in Nigeria, primarily operating in Lagos, offering personal loan services. Known for its high maximum loan limit of up to ₦5,000,000 and a commitment to quick disbursement, C24 caters to a specific segment of the market with its tailored loan products.

Requirements to get a loan:

C24’s loans are exclusively available to residents and workers in Lagos. Applicants are required to have been employed for at least six months and must possess a good credit score. The application process necessitates a verifiable monthly income, pension account, employment letter, pension statement, bank statement, staff ID, valid ID, and a utility bill.

Specific interest rates for C24 loans are not publicly disclosed. However, there is a management fee involved, the exact figure of which is not specified on their website. Additionally, a 1% default penalty is applied for late repayments.

Based on Google reviews, C24 has received varied feedback from its customers. While some appreciate the fast disbursement and high loan limits, others find the application process cumbersome.

C24’s engagement with customer feedback, especially on platforms like Google reviews, is indicative of their customer service approach. However, the effectiveness of their responses in resolving customer issues varies.

C24, like other financial institutions, is expected to adhere to standard security and privacy protocols to protect customer data. However, detailed information about their specific practices in this regard is not readily available.

C24 offers a robust personal loan service, particularly appealing to those in need of substantial loan amounts and quick disbursement. The rigorous application process and geographic limitation to Lagos are factors to consider for potential borrowers.

C24’s personal loan service stands out for its high loan limits and fast processing times. However, the service’s reach is limited to Lagos, and the detailed application requirements may pose a challenge for some. Prospective borrowers should weigh these factors against their personal needs and circumstances before proceeding with an application.

It’s that fast and simple.

₦10,000 Loan ● ₦20,000 Loan ● ₦30,000 Loan ● ₦40,000 Loan ● ₦50,000 Loan ● ₦100,000 Loan ● ₦200,000 Loan ● ₦300,000 Loan ● ₦500,000 Loan ● ₦1 Million Loan ● ₦3 Million Loan ● ₦5 Million Loan ● ₦6 Million Loan

● Online Loan ● Emergency Loan ● Payday Loan ● Debt Consolidation ● ● Rent Loan ● Travel Loan