Baobab Business Loan Review

- Posted by Credit Nigeria

Baobab Microfinance Bank, a key player in Nigeria’s financial sector, commenced operations in 2010 as a subsidiary of the Baobab Group. Formerly known as Microcred Nigeria, the institution has shown remarkable growth since its inception. From an initial loan book of ₦257 million in 2010, it expanded significantly to ₦4.7 billion by 2018. Baobab has established itself as a reference partner for individuals, entrepreneurs, and micro-entrepreneurs in Nigeria, serving over 200,000 clients and disbursing loans exceeding ₦196 billion while managing savings of over ₦18 billion.

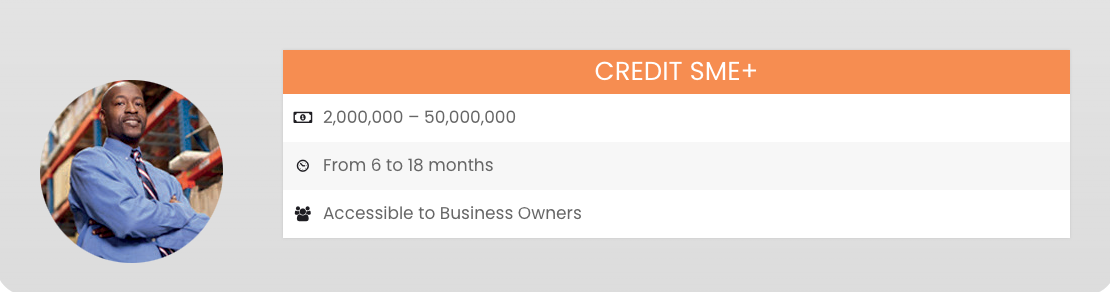

Baobab Nigeria offers a variety of loan products designed to cater to the diverse needs of business owners:

To access Baobab’s loan facilities, applicants must own a business within Baobab’s lending areas, including states like Anambra, Lagos, Oyo, and others. The business should have been operational for a specified period. The process is streamlined to ensure efficiency, with disbursement possible within three working days, provided all requirements are adequately met.

Baobab’s interest rates vary depending on the loan amount but are very competitive. Notably, there are no fees or mandatory account openings required before securing a loan.

Customers have praised Baobab for its customer-centric approach. Testimonials from satisfied clients, like Augustus Omokaro Eriaria and Mr. Enwerem Patrick, highlight the straightforward and efficient loan application process that eliminates cumbersome paperwork.

Baobab is recognized for combining financial sustainability with positive social and environmental impacts. The institution adheres to internationally recognized good governance and institutional ethics best practices. It also implements a credit rating methodology to precisely assess borrowers’ financial situations, ensuring responsible lending practices.

Baobab Nigeria emerges as a reliable and efficient lender in the Nigerian business landscape. Its diverse loan products, competitive interest rates, and commitment to client protection and ethical practices make it an appealing choice for entrepreneurs seeking financial support for their businesses.

It’s that fast and simple.

₦10,000 Loan ● ₦20,000 Loan ● ₦30,000 Loan ● ₦40,000 Loan ● ₦50,000 Loan ● ₦100,000 Loan ● ₦200,000 Loan ● ₦300,000 Loan ● ₦500,000 Loan ● ₦1 Million Loan ● ₦3 Million Loan ● ₦5 Million Loan ● ₦6 Million Loan

● Online Loan ● Emergency Loan ● Payday Loan ● Debt Consolidation ● ● Rent Loan ● Travel Loan