C24 Capital Business Loan Review

- Posted by Credit Nigeria

C24 Capital, a financial institution in Nigeria, specializes in providing retail loans for consumers in need of quick financial solutions. The company, headquartered in Lagos, emphasizes ease of access to its services, which can be availed online using any internet-enabled device.

C24 Capital offers a range of loan products tailored to different needs. The types of business loans provided are:

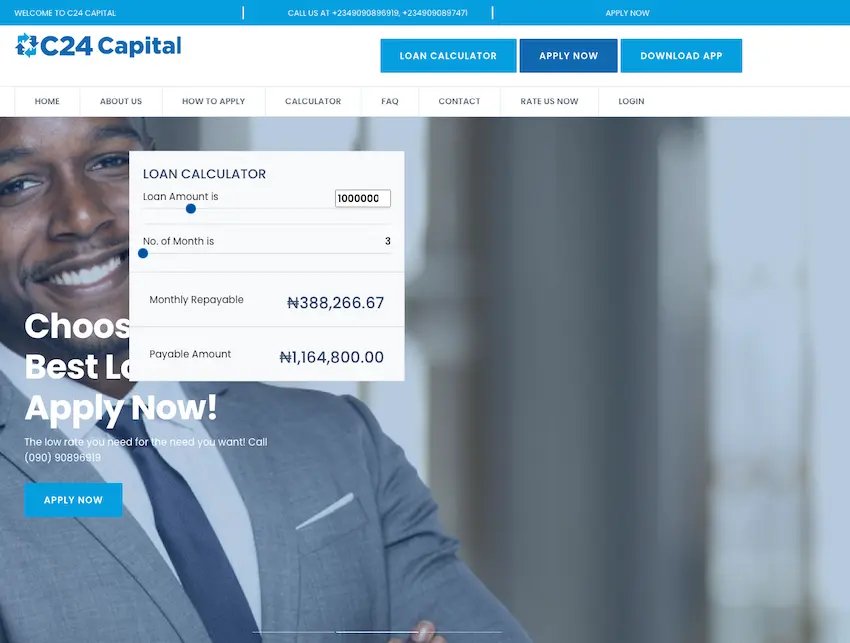

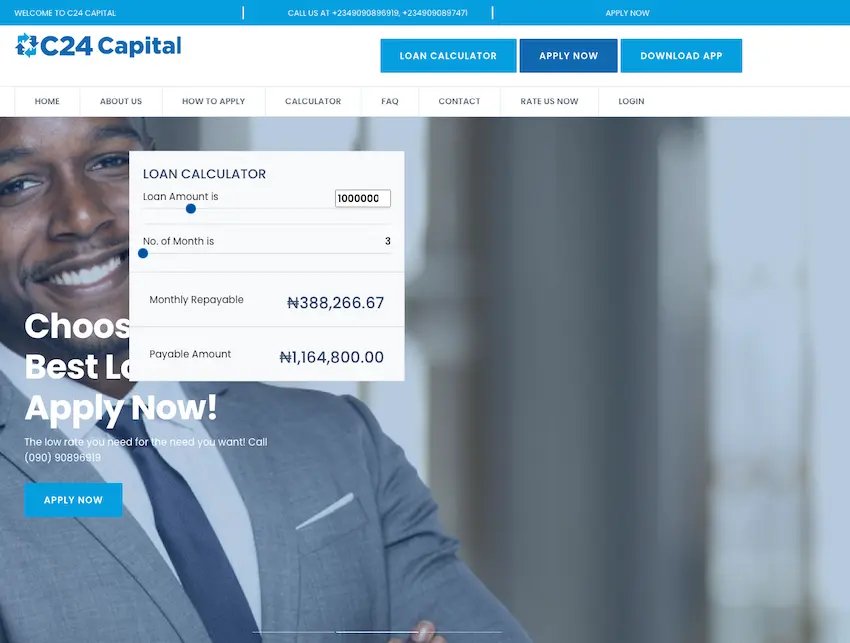

C24 Capital charges an interest rate of 4% monthly and a one-time 4% management fee. The management fee is included in the repayment plan. Loan repayment periods range from three to nine months, with options for repayment through direct debit, cheques, and POS terminals. Notably, C24 imposes a 1% daily charge for late repayments.

The eligibility criteria for C24 loans include being actively employed or having worked for at least six months before the application. Applicants must be at least 22 years old, have a functional bank account, and demonstrate sufficient transactional history to ensure repayment capability.

While customer experiences and testimonials need to be more detailed in the sources, the company’s rapid approval process and flexible loan options are highlighted as strengths. However, it’s important to note that the services are geographically restricted to Lagos and involve substantial paperwork.

C24 Capital is known for its fast approval process and a high maximum loan limit. However, the company’s operations are limited to Lagos, which is a significant geographical limitation. Additionally, the application process involves considerable paperwork, which might be a drawback for some customers.

C24 Capital stands out in the Nigerian market for its swift loan approvals and flexible rates. The company’s emphasis on accessibility and online service delivery aligns with contemporary consumer needs. Despite the geographical limitations and paperwork involved, C24 remains a viable option for those in Lagos seeking quick financial solutions.

It’s that fast and simple.

₦10,000 Loan ● ₦20,000 Loan ● ₦30,000 Loan ● ₦40,000 Loan ● ₦50,000 Loan ● ₦100,000 Loan ● ₦200,000 Loan ● ₦300,000 Loan ● ₦500,000 Loan ● ₦1 Million Loan ● ₦3 Million Loan ● ₦5 Million Loan ● ₦6 Million Loan

● Online Loan ● Emergency Loan ● Payday Loan ● Debt Consolidation ● ● Rent Loan ● Travel Loan