Carbon Loan – A Comprehensive Lender Review

- Posted by Credit Nigeria

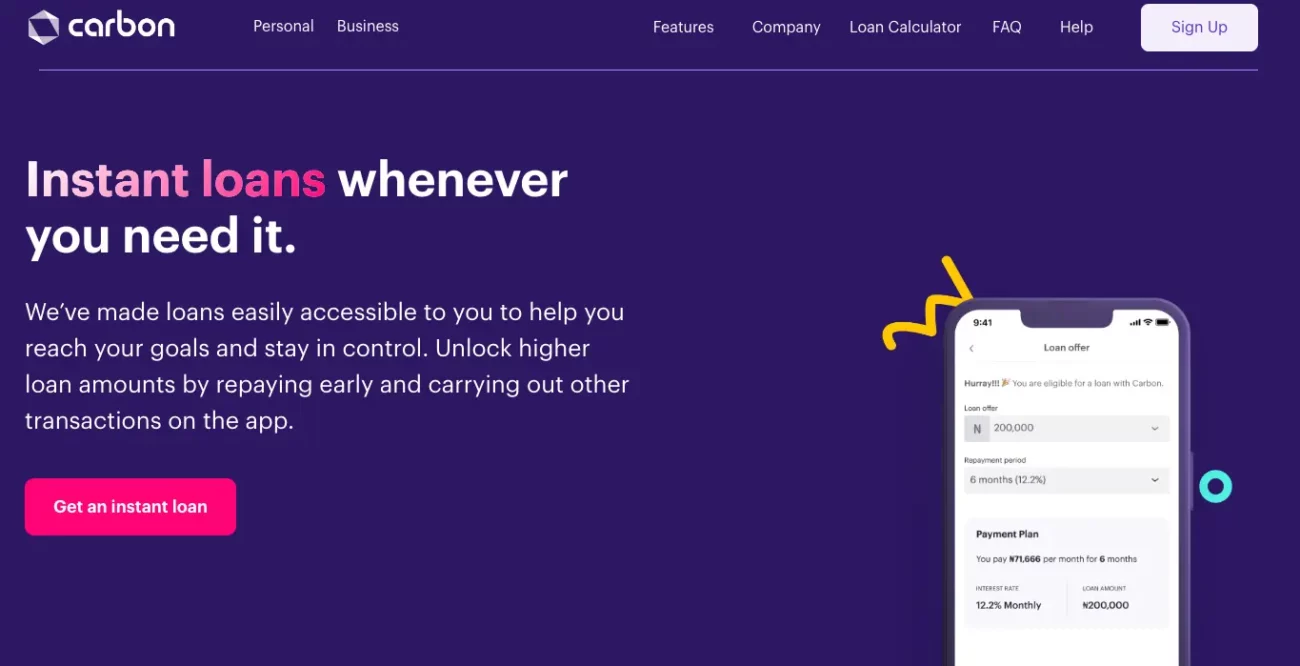

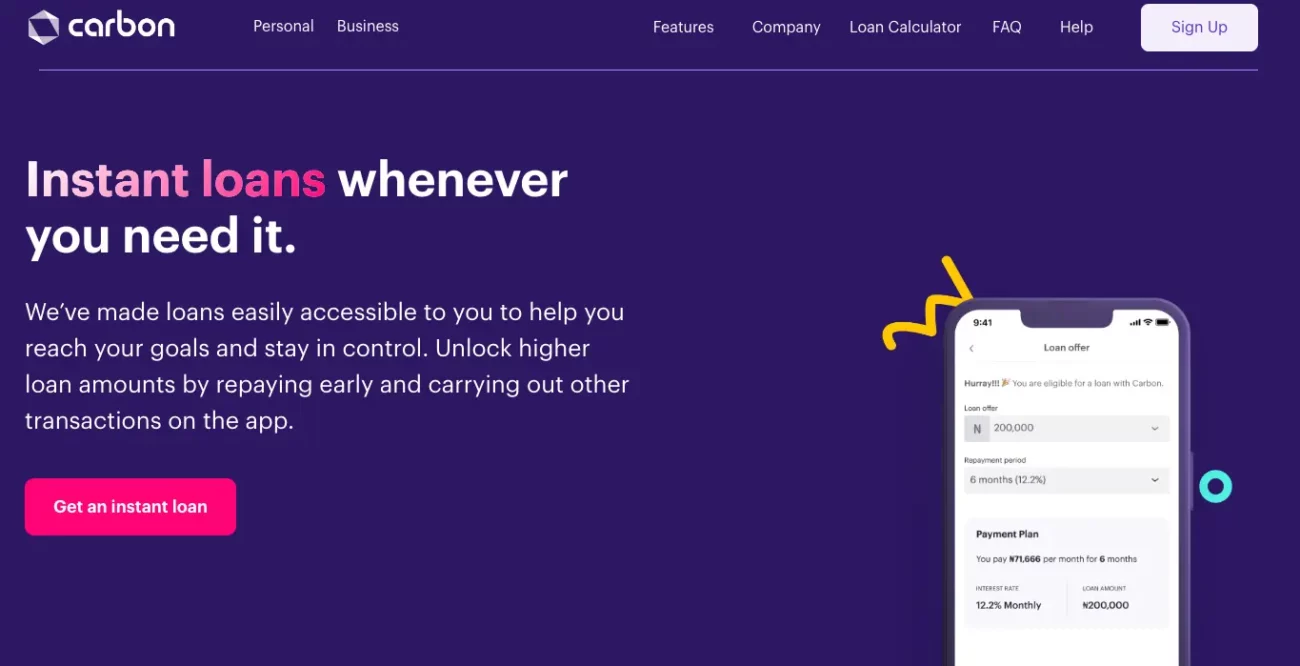

Carbon, a prominent digital bank in Nigeria, offers a diverse range of financial services, including loans, savings, and investment options. Known for its digital-first approach, Carbon has carved a niche in the fintech sector, providing accessible financial solutions through its mobile application.

Carbon Review - Summary

Requirements to get a loan:

Carbon offers loans ranging from ₦2,500 to ₦500,000, with terms extending from 1 month to 12 months. The application process is digital, requiring personal details, Bank Verification Number (BVN), valid identification, bank statement, and employment details. The platform’s nationwide accessibility makes it a convenient option for borrowers across Nigeria.

Carbon’s interest rates range from 4.5% to 30%. There is also a 5% origination fee. However, there’s no monthly fee, excluding the interest rate. The fee structure, particularly the origination fee, needs clarification as it appears to vary.

On Pissed Consumer, Carbon’s reviews provide insights into customer experiences. While detailed reviews are limited, the feedback available suggests a mixed response to Carbon’s services.

Carbon’s engagement with customer feedback, especially on platforms like Pissed Consumer, is crucial in addressing concerns and improving services. Currently, there is limited interaction observed, indicating an area for potential enhancement in customer relations.

As a digital bank, Carbon prioritizes user data security and privacy. However, the extent of data usage for credit scoring and other purposes should be transparently communicated to users.

Carbon stands out for its quick loan disbursement and user-friendly loan application process. However, the low initial maximum loan limit and the application’s user interface complexity are areas that need attention. Users should also be mindful of the fee structure and privacy aspects related to the application process.

Carbon offers a range of convenient financial services with competitive interest rates and a user-friendly mobile app. While it excels in providing digital financial solutions, it must address concerns related to its application process and clarify its fee structure to maintain and enhance trust among its users.

It’s that fast and simple.

₦10,000 Loan ● ₦20,000 Loan ● ₦30,000 Loan ● ₦40,000 Loan ● ₦50,000 Loan ● ₦100,000 Loan ● ₦200,000 Loan ● ₦300,000 Loan ● ₦500,000 Loan ● ₦1 Million Loan ● ₦3 Million Loan ● ₦5 Million Loan ● ₦6 Million Loan

● Online Loan ● Emergency Loan ● Payday Loan ● Debt Consolidation ● ● Rent Loan ● Travel Loan