Navigate Your Financial Journey with Confidence

Credit Nigeria helps you search for loan offers you are eligible for.

- Compare and save on loan fees.

- No collaterals needed.

- No extra fees.

More than 300,000 users

Helping You Finance Your Future

Understanding money management, credit, and investment fundamentals is no longer optional, but essential. Financial literacy gives you the tools and knowledge to make informed decisions, providing stability, growth, and a secure financial future.

Whether you’re navigating the difficulties of loan agreements, exploring avenues for savings, or seeking strategies for debt repayment, a solid foundation in financial principles paves the way to personal prosperity. Our platform demystifies these concepts, guiding you through every aspect of financial education and helping you unlock the door to financial well-being.

What Do You Want to Learn More About?

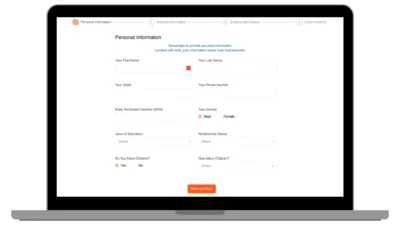

How Our Loan Offer Service Works For Borrowers

Complete and submit your loan form with your details. Remember to be as accurate as possible.

Compare loan interest rates and other fees from lenders that will most likely grant you a loan.

After you choose the best loan offer, the lender will shortly contact you for final due diligence and loan disbursement.

We Only Partner with Reliable Lenders

₦10,000 Loan ● ₦20,000 Loan ● ₦30,000 Loan ● ₦40,000 Loan ● ₦50,000 Loan ● ₦100,000 Loan ● ₦200,000 Loan ● ₦300,000 Loan ● ₦500,000 Loan ● ₦1 Million Loan ● ₦3 Million Loan ● ₦5 Million Loan ● ₦6 Million Loan

● Online Loan ● Emergency Loan ● Payday Loan ● Debt Consolidation ● ● Rent Loan ● Travel Loan